Insight

ClearScore Credit Health

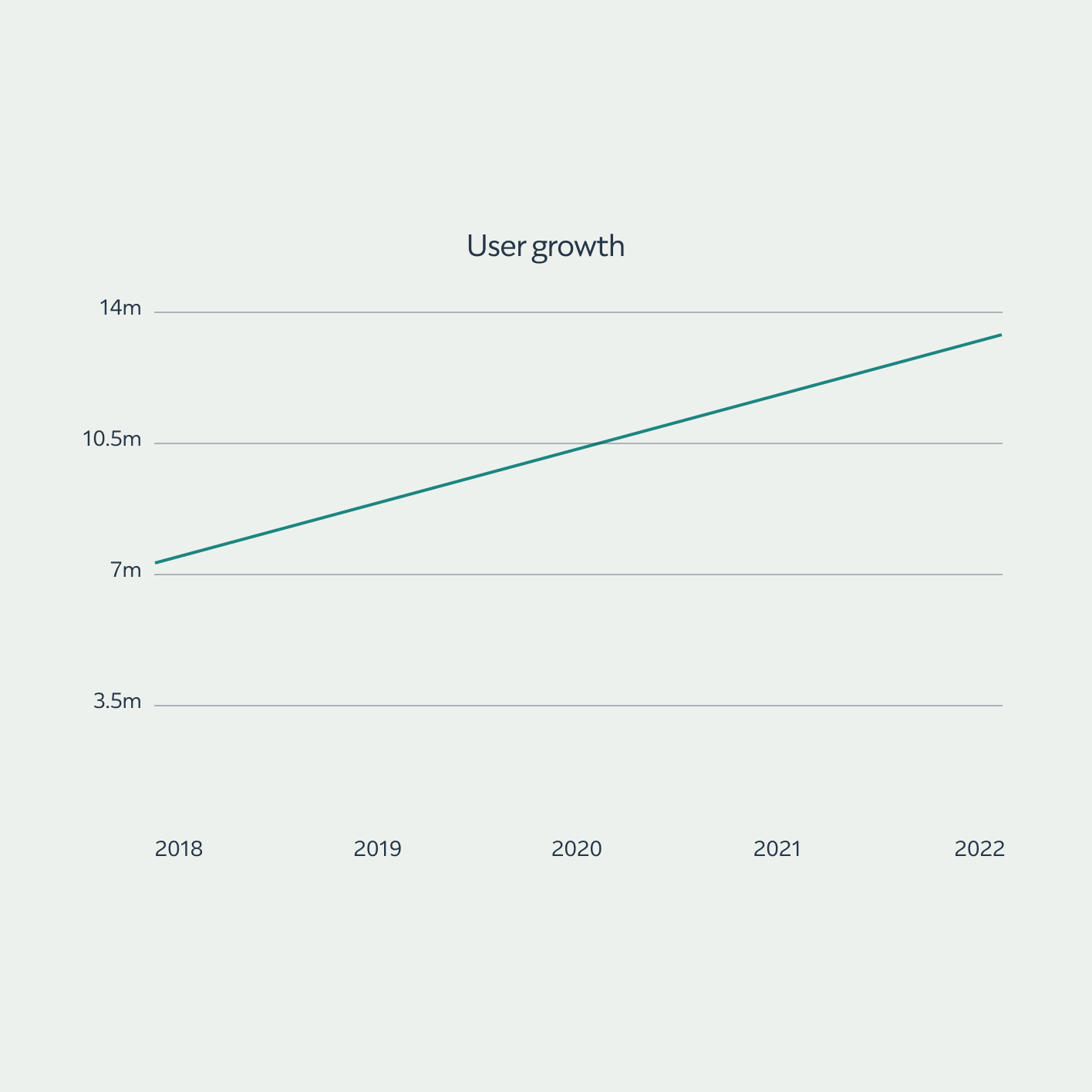

Founded in 2015, ClearScore was the first UK company to offer free access to credit scores and reports. This pioneering approach quickly propelled ClearScore to become the UK's leading credit health service, expanding into four markets and serving over 20 million users.

Client: ClearScore,

Project: Mobile app,

Role: Design Lead

Project: Mobile app,

Role: Design Lead

Idea

Your credit score and report. For free, forever

In the past, applying for credit often felt like a shot in the dark. You'd either be accepted or rejected, with little insight into how the decision was made.

But imagine if everyone had free, unlimited access to their credit history. What if the power to understand and improve your financial standing was in your hands? This is exactly what ClearScore set out to achieve.

ClearScore was founded on a simple yet transformative idea: to empower individuals by providing free access to their credit reports. By doing so, ClearScore enables people to take control of their finances, improve their credit scores, and ultimately reach their financial goals.

But imagine if everyone had free, unlimited access to their credit history. What if the power to understand and improve your financial standing was in your hands? This is exactly what ClearScore set out to achieve.

ClearScore was founded on a simple yet transformative idea: to empower individuals by providing free access to their credit reports. By doing so, ClearScore enables people to take control of their finances, improve their credit scores, and ultimately reach their financial goals.

Idea

User first. Revenue second

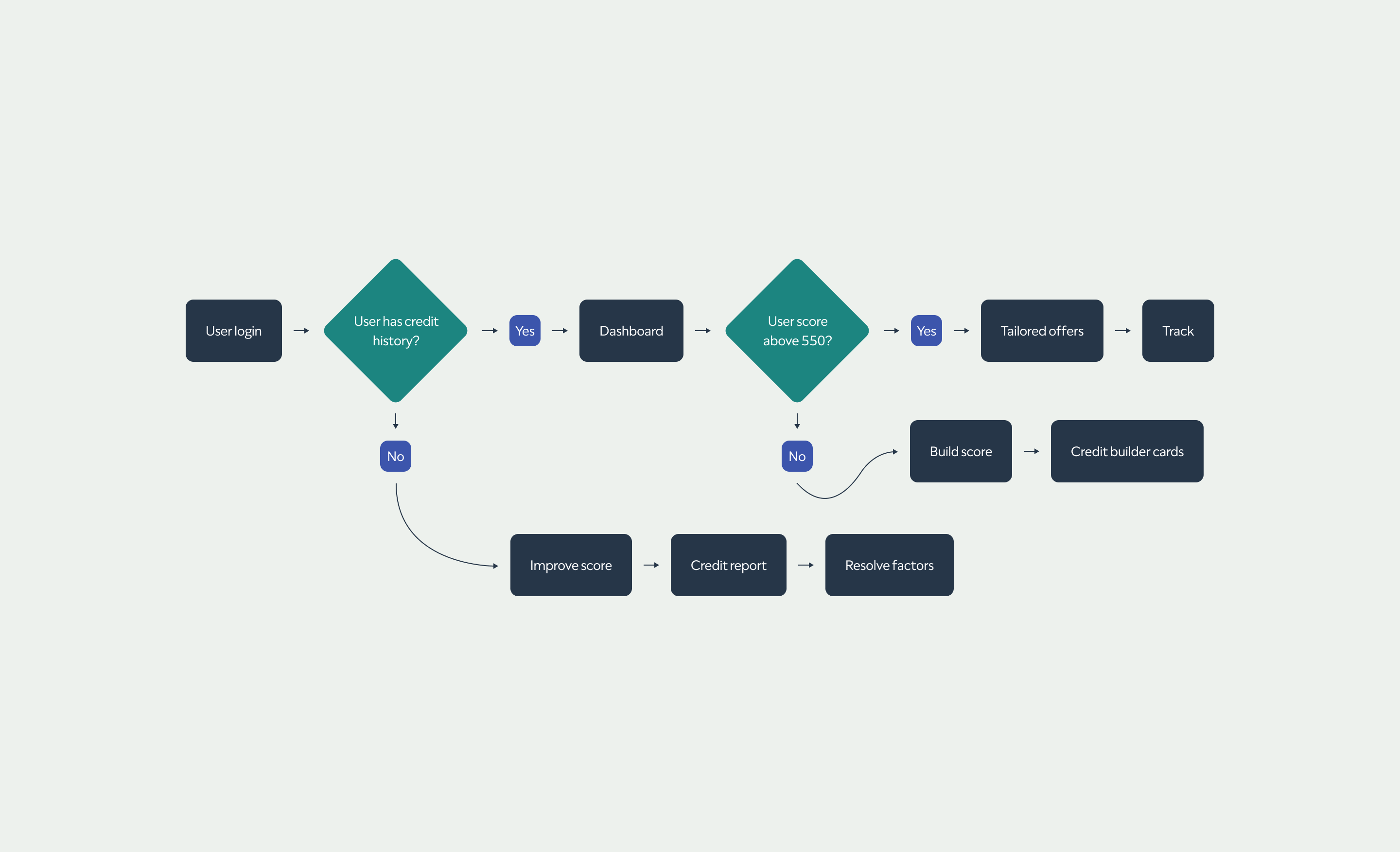

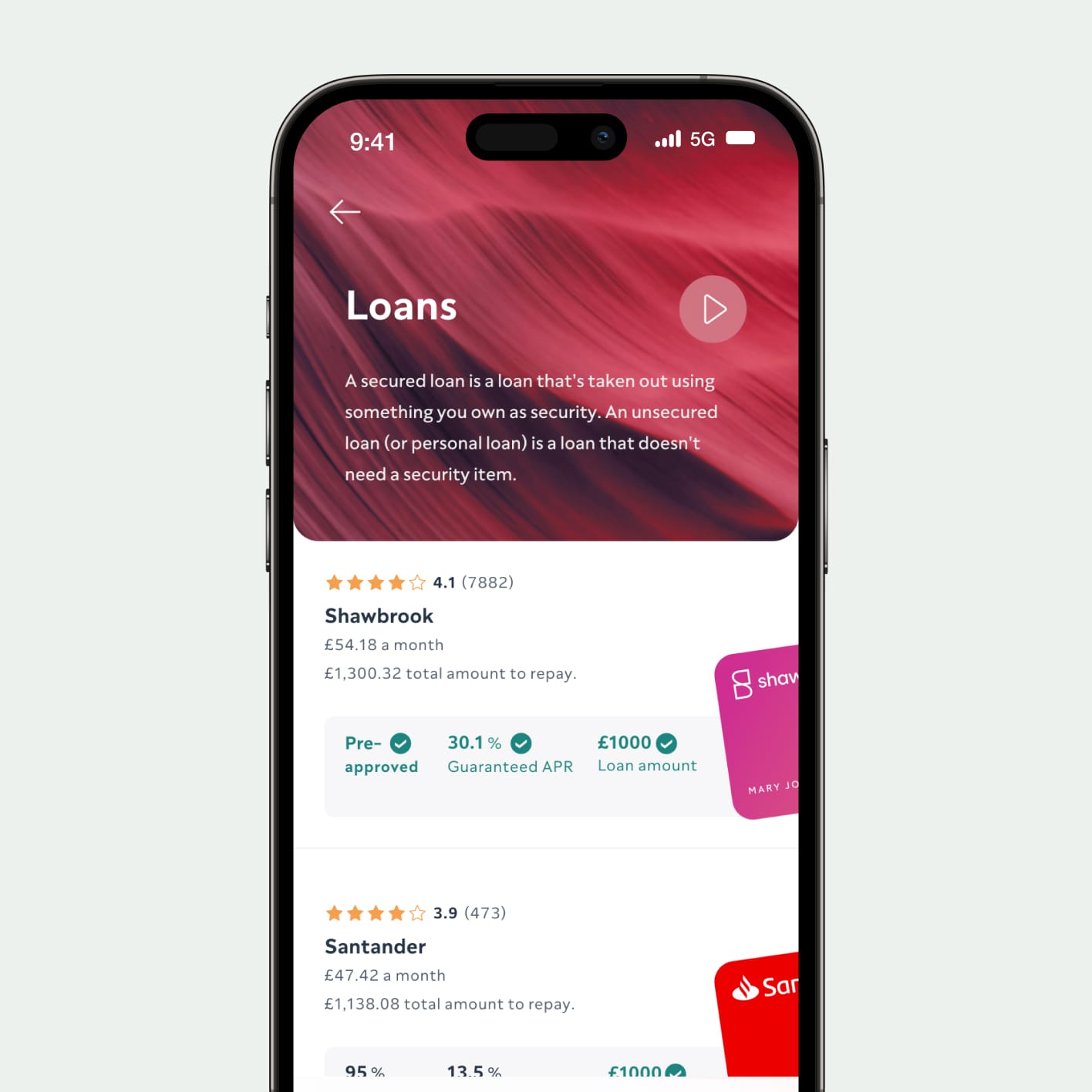

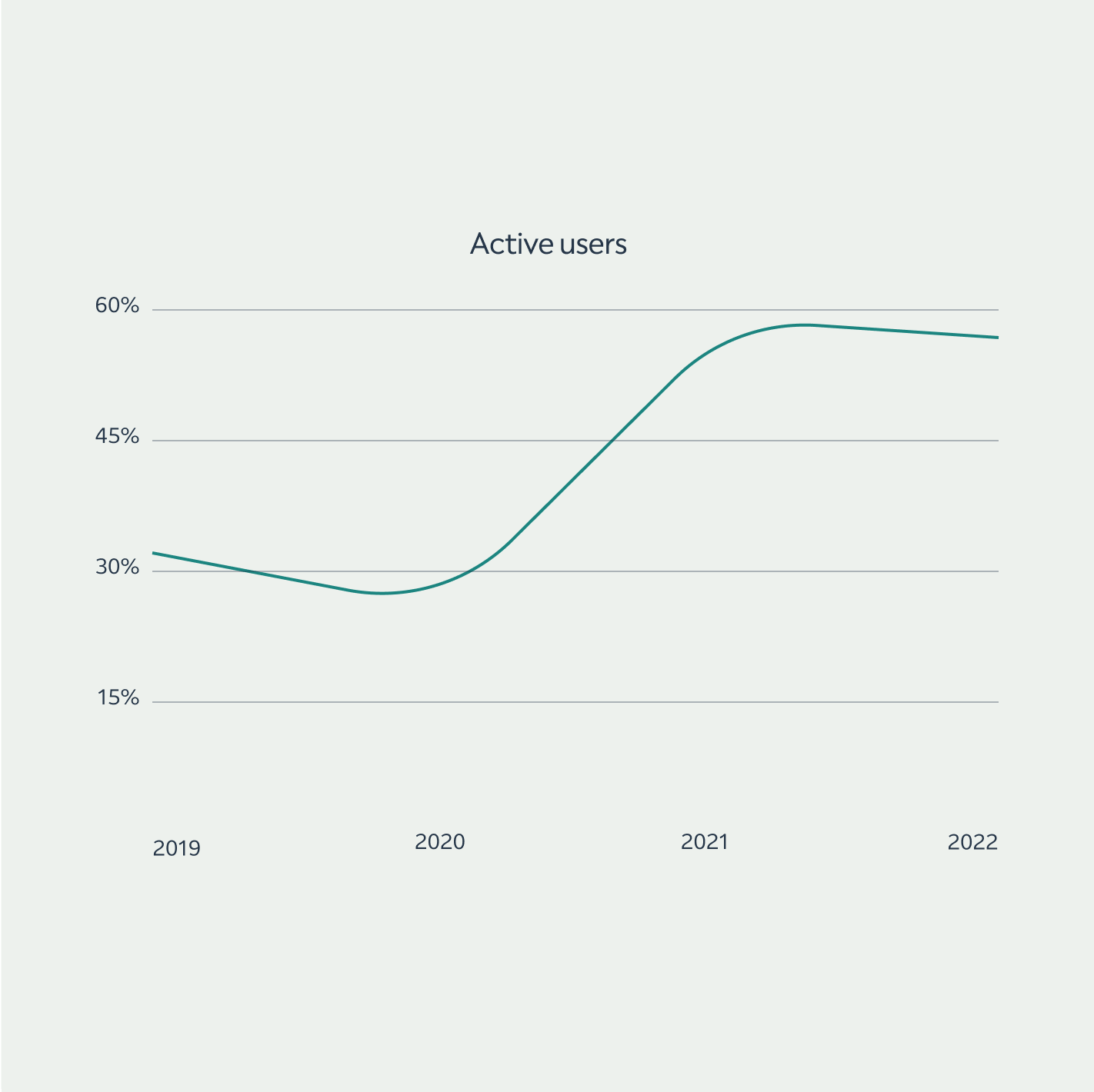

ClearScore's business model was straightforward: attract users, help them improve their credit scores, and present them with tailored, Pre-Approved offers. In return, ClearScore sought to build trust with its users and generate revenue through successful product conversions.

Idea

From credit check to financial well-being

ClearScore's business model was successful, but evolving market dynamics and changing user needs led the company to rethink its approach. ClearScore recognized that each user is unique, with individual circumstances and financial goals, requiring a more personalized approach to its services.

Idea

Helping people achieve their financial goals

The solution was a personalized ClearScore, designed to adapt to the diverse and complex needs of each user.

Idea

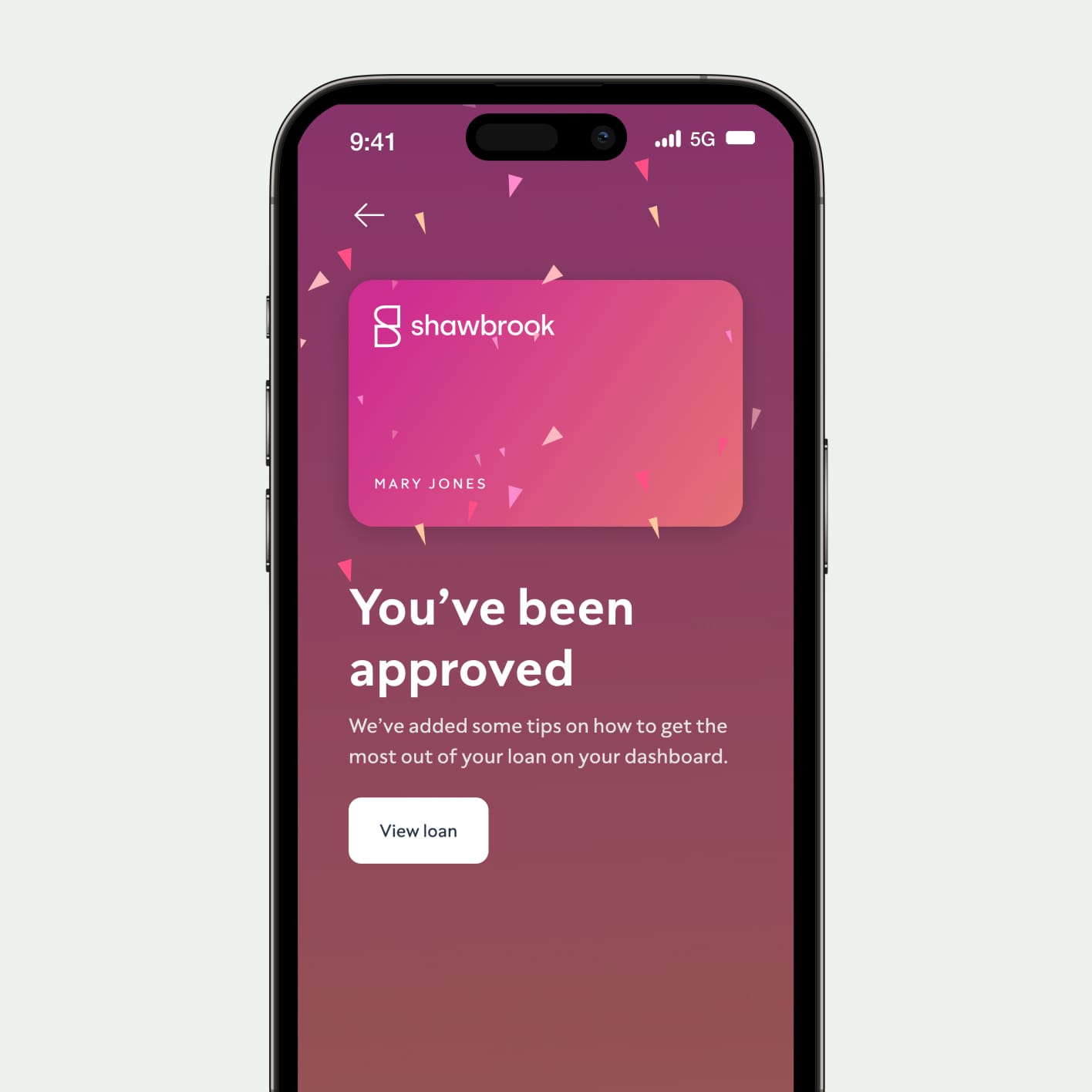

Apply on ClearScore

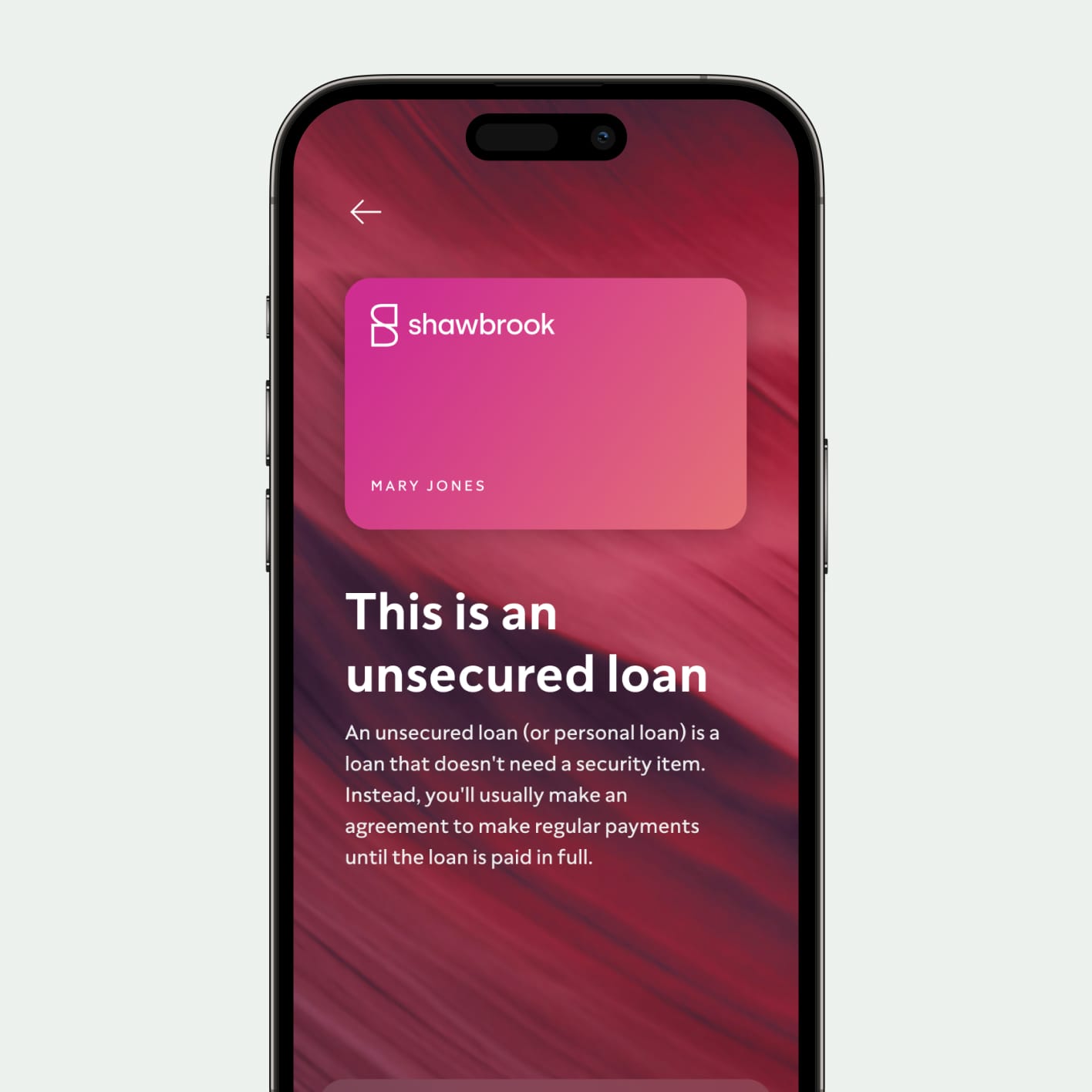

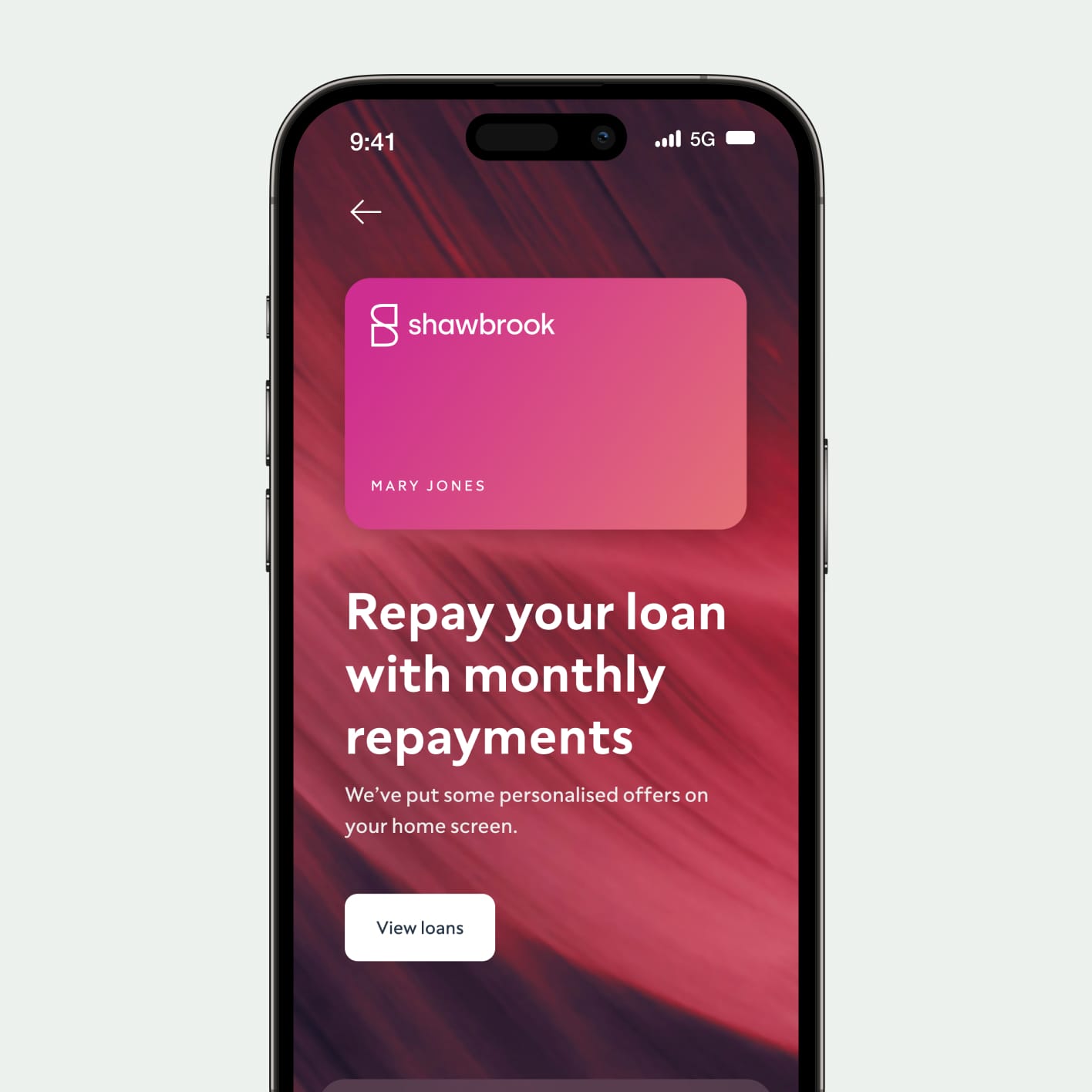

With Apply on ClearScore, we made it even easier for users to secure the financial products they need to achieve their goals. By integrating the entire application process into ClearScore's ecosystem, users can now complete everything—from document signing to income verification—within minutes and with fewer clicks than ever before.

Impact

The UK’s Number One Credit Health Service

After expanding its focus to financial well-being, ClearScore became a widely trusted financial service, providing over 20 million people with access to their credit information. Today, the business operates in four global markets: the UK, South Africa, Australia, and Canada.

Case Study

From credit check to financial well-being

For a deeper dive into the evolution of ClearScore's products and services, check out my case study. If you're interested in collaborating or want to learn more, feel free to get in touch.

My Role

As ClearScore’s Principal Designer and Head of UI, I played a key role in shaping the design strategy and future vision for our digital products. I led the design direction on projects across acquisitions, engagement, and marketplace, and spearheaded research and design for new business ventures, including DriveScore and ClearScore's next-gen credit health app.